The Indian healthcare industry is one of the largest industries in the world, and has been growing much faster after COVID-19. While most businesses are hit by the ongoing pandemic, the healthcare market has seen a sudden rise in business and is expected to increase three-fold to Rs 8.6 trillion (US$ 133.44 billion) by 2022. The dependence on mobile technology and online services has increased manifold during the COVID-19 pandemic in almost every sector, including healthcare platforms too. While brands like Practo, Pharmeasy and Netmeds had already made their presence felt even before the pandemic, 2020 has really seen this set of brands come of age and affirm their meaningfulness to consumers. With online consultations and purchase of medication becoming the need of the hour during the COVID-19 outbreak, consumers are turning to these companies to address their needs.

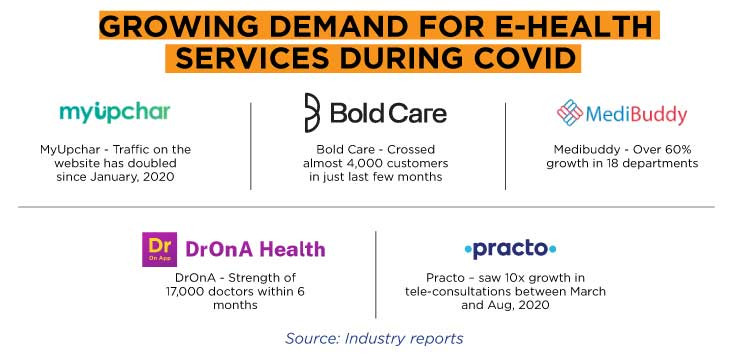

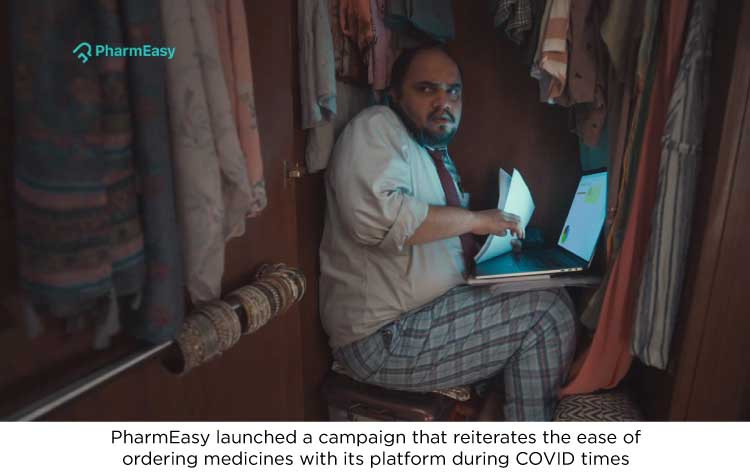

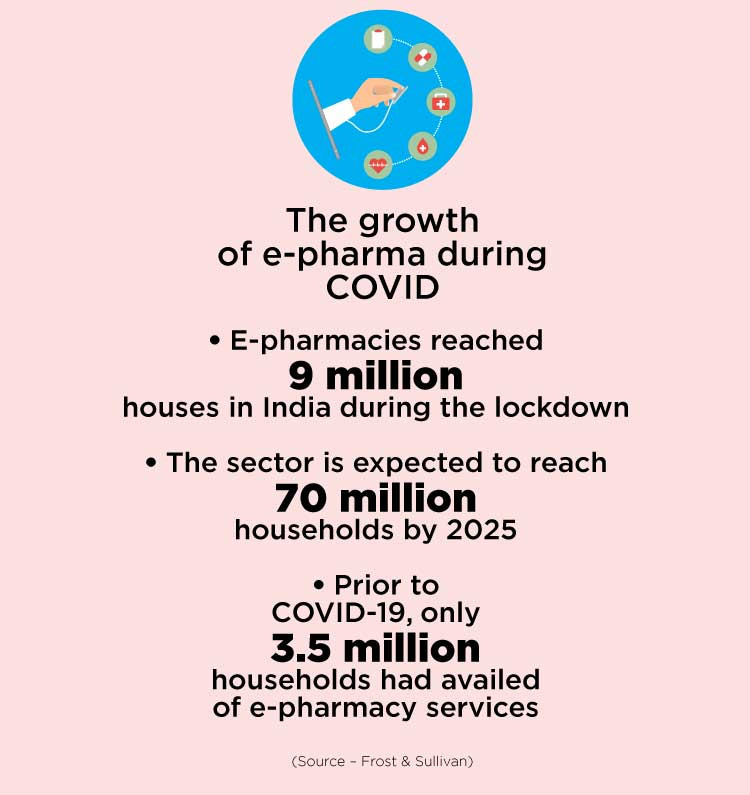

Preeti Mascarenhas, Head of Product and Strategy, Mindshare India explains that there is scope for enhancing healthcare services while anticipating that online consultation will grow even post the COVID pandemic. “There is a significant scope for enhancing healthcare services considering that healthcare spending as a percentage of GDP is rising. In online services, brands like Pharmeasy, Netmeds and 1mg.com have grown by 45 -50% in terms of visits and also the searches have increased by 58% post lockdown. One of the growing trends is also consultation online and we will see this trend growing post COVID definitely,” she notes.

The rise of this new category has also seen the entry of big companies such as e-commerce giant Amazon, which recently marked its entry into the space with the launch of Amazon Pharmacy. Amazon has already started a pilot project of e-pharmacy in Bengaluru and it plans to expand to other cities too. “This is particularly relevant in present times as it will help customers meet their essential needs while staying safe at home,” says an Amazon spokesperson. Likewise Reliance Industries Limited has also gone on to acquire e-pharma firm, Netmeds through its retail subsidiary for approximately Rs 620 crore. Recently, the Tata Group was also reported to be eyeing stakes in 1MG.

HOW ARE BRANDS ADVERTISING?

With concerns growing around health and hygiene, brands too have been quick to adapt to the new normal. In the past six months, brands and companies across sectors have been launching products and services to cater to these new consumer needs. “The inventory of top 10 advertisers including leading FMCG companies such as HUL and RB has increased by 34% in the unlock period compared to pre-COVID-19 levels. Interestingly the hygiene category went up. Rubs and balms have increased by 85% from Jan to Sept, 2020, while vitamin, tonic and health supplements grew by 50-60% approximately,” reveals Mascarenhas.

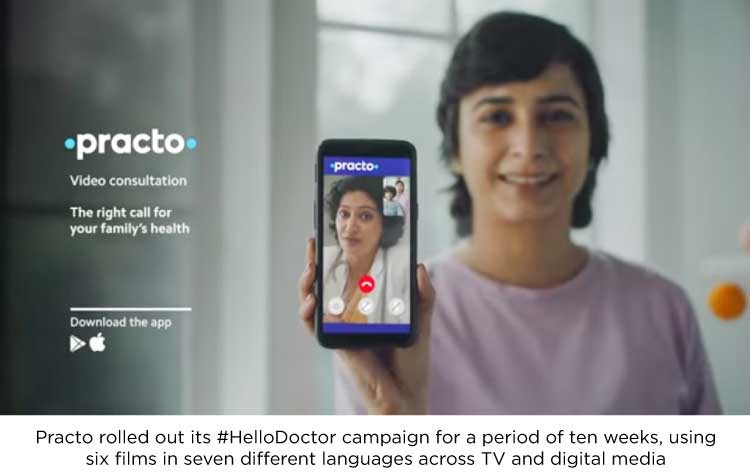

Brands like Practo have been quick to recognise and address this growing demand, launching relevant ad campaigns. Practo launched a TV campaign #HelloDoctor to urge consumers to seek expert healthcare advice online from the safety of their homes Practo.

Likewise, healthcare start-up MyUpchar partnered with Amazon to power Hindi health queries on Alexa. With the partnership, the company is making its content available on Alexa to enable and empower customers to get answers to queries about everything from symptoms and treatment of diseases, diets, nutrition, etc. The brand has also witnessed a 25% rise in tele-consultations post the lockdown.

Brands also leveraged big properties like the IPL to launch TV campaigns. Medibuddy launched its first TV campaign ‘Aapka Health Buddy’ that aired on multiple channels on television and during IPL on Hotstar. Speaking about the brand’s approach during this year, Satish Kannan, Co-founder & CEO, MediBuddy-DocsApp says, “We are actually partnering with multiple sports, and IPL is one of them. So, we’ve launched a TV campaign in order to create more awareness across the country, that’s because TV and IPL is watched by large audiences.” Docterz is also planning to launch various initiatives and marketing campaigns on super speciality clinics. While the more established brands in this space are already advertising on TV, the emerging brands are looking at creating a stronger connect with consumers on Digital.

DIGITAL HEALTHCARE – THE NEW CATEGORY OF ADVERTISERS

REGULATIONS ON E-HEALTH

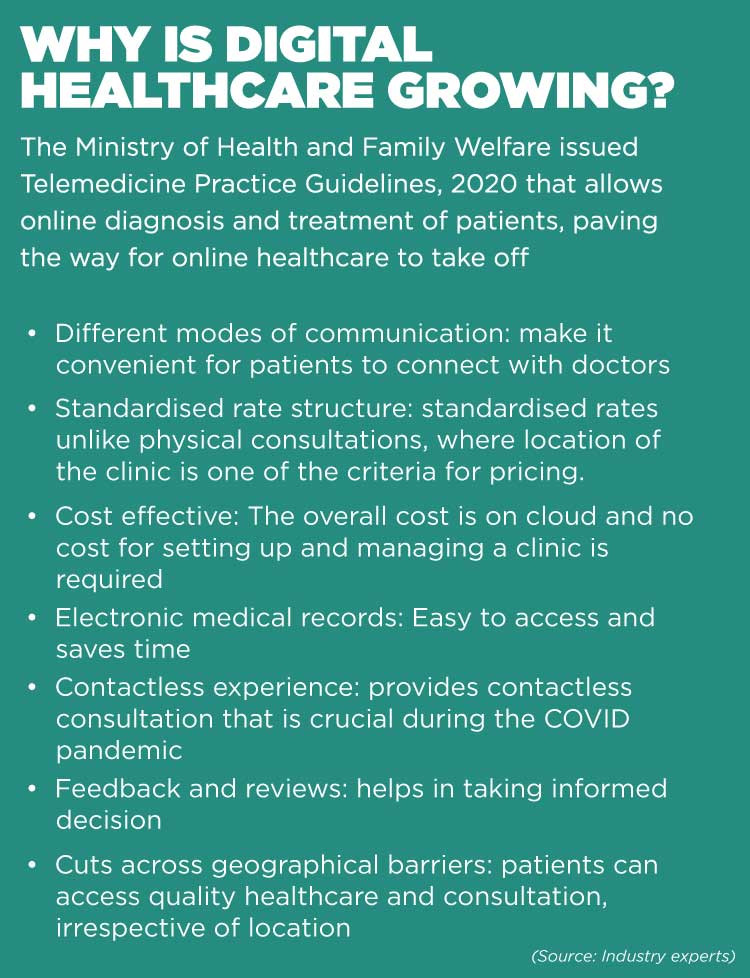

After the nationwide lockdown was imposed, the Ministry of Health and Family Welfare issued Telemedicine Practice Guidelines, 2020 that allowed the diagnosis and treatment of patients using telecommunication and digital technology. Consumers today can choose to get healthcare consultations over phone calls, text messages, WhatsApp and video.

Speaking about how the new telemedicine guidelines changed the landscape for digital healthcare, Rajat Garg, Co-Founder & CEO, myUpchar explains, “Earlier, the biggest challenge was that online services were in a grey area and there was mistrust around online services. However, telemedicine guidelines have changed the scenario and a lot of doctors themselves have come on such platforms now. We saw a huge jump during the lockdown and even after the lockdown the consultation volume has increased by 25% in the last two months.”

Technology was already there but COVID-19 brought change in terms of regulations and helped develop confidence among both doctors and patients, says Rajat Jadhav, Co-founder, Bold Care, “In a short span of time, the government released regulations for telemedicine, outlining how telemedicine should be practised, which not only gave confidence to start-ups and investors but also to the doctors.”

TOWARDS A TECH SAVVY HEALTHCARE SYSTEM

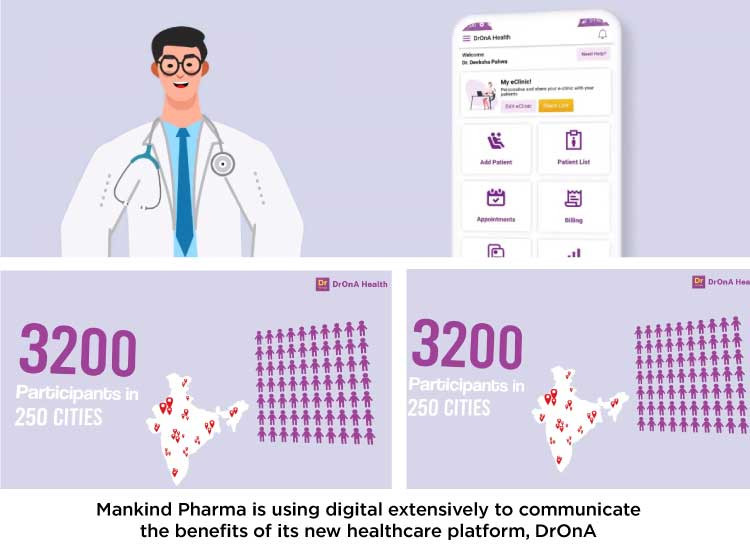

According to Mindshare’s New Normal Tracker report, confidence in digital health services has more than doubled with 28% patients consulting doctors online pre-COVID versus 64% patients who consulted doctors online post-COVID. Mankind Pharma has developed a one-stop solution with DrOnA, offering technological solutions to doctors to help them connect with their patients and manage their offline operations as well. Chanakya Juneja, Promoter, Mankind Pharma says, “Our vision through DrOnA was to create a super app. So unlike other apps, we offer all the free services in one go. We have tele-consultation and it’s a training management system overall. It is a one-stop solution where doctors can connect with the patients, manage their clinics and gain some knowledge about what is happening in the medical field around the world.”

These healthcare platforms only work with mild illnesses and not any serious health concerns but it definitely helps shorten the time one would waste in a hospital, explains Pooja Jauhari, CEO The Glitch. “Healthcare companies are operating like tech companies. The cost efficient access we now have by online consultations has been quite a game changer. I however do feel that this is also making this industry more and more transactional. The lockdown however has pushed this industry forward many years, and adapting mHealth no longer seems like a daunting aspect.”

BREAKING GEOGRAPHICAL BARRIERS

The rise of digital healthcare has also created a bridge between the doctors and patients while overcoming the geographical barriers. According to a recent survey conducted by Mankind Pharma and DrOnA, metros have witnessed a higher adoption while non-metros are catching up in telemedicine. It has also seen a rise in the eastern part of the country across Bihar, Jharkhand and West Bengal. The access to quality healthcare over digital platforms helps eliminate geographical barriers present in smaller, remote regions. Explaining this, Satish Kannan, Co-founder & CEO, MediBuddy-DocsApp says, “During the past 6-7 months, doctors and hospitals have adopted technology and solutions to connect with patients online. And that has helped in increasing availability because earlier hardly any doctor was available online or accessible through a video call. Now, location or geography is not a problem anymore, people from small towns who earlier used to travel to big cities can consult a doctor of their choice online. Earlier, people would travel across Maharashtra to consult a doctor in Mumbai or even travelled from North East to Chennai.”

The findings from Kantar’s recent study, ‘The D-Picture- COVID Edition’ highlights that despite the lockdown, >70% people consulted their physician in the period (April – Sept 2020). The findings also show that remote patient monitoring is on the rise with video/ virtual consultations using digital apps showing a sharp rise from 3% pre-COVID to 13% during COVID. Apart from using apps, an increasing number of patients have also resorted to texting doctors on WhatsApp (10% pre-COVID, up to 26% during COVID).

Highlighting that people from Tier 2 and 3 regions and even remote areas are consulting doctors through WhatsApp, Garg observes, “Instead of giving medicines like most general physicians, these doctors prescribe medicines online and the patients then buy it from a local chemist store. In Kota, a doctor’s 30-35% business is happening through online portals. Earlier, it was zero and even after the lockdown was lifted, 35% business has been coming from e-consultations.”

IS DIGITAL HEALTHCARE THE FUTURE?

As the boost in growth for most online healthcare platforms happened after the pandemic struck, the important question is whether digital e-healthcare is here to stay.

Dr Atish Laddad, Founder & Director, Docterz explains that online and offline healthcare has to go hand in hand. “Online healthcare has to go hand in hand with offline healthcare. Only online healthcare has its own set of challenges. So a mixed approach is going to help. Online healthcare is going to form not more than 10% of the market, 5% to 10% of the OPD consulting market. 90% market is still going to be offline consultation.” Online healthcare will definitely get better in terms of the traction and people subscribing to it. The quality will improve, says Rishikesh Kumar, Founder & CEO, Xtraliving. “Physical format will definitely not vanish. In most of the fitness centres and sports facilities, people will return if they maintain good quality and hygiene. The future will see a deep integration of physical and online formats.”

Gauri Pathak- General Manager, Health Division, Kantar observes that some of the changes are likely to retreat after pandemic slows down. "The pandemic has changed various facets of the healthcare sector. Some of these are transient changes which are likely to retreat as and when the pandemic slows down. However, some changes are likely to be long lasting and may continue even in a COVID-free world."

THE CHANGING PHARMA MARKETING LANDSCAPE AMID COVID-19

Dr Harshit Jain, Founder & CEO, Doceree explains why the future of pharma lies in Digital

Pharma marketing was all about sales representatives meeting physicians in person and briefing them about their company’s product and services, new launches or sharing a sample with them. This all happened majorly face-to-face, until COVID-19.

The pandemic brought a drastic shift in the way Rx drug brands engaged with physicians. The traditional ‘in-person’ marketing strategy became unfruitful for Pharma brands to reach out to Physicians amid lockdown and social distancing criteria.

Pharma marketers go the digital way

A sector – pharma – that was the most reluctant to adopting digital technologies and related partnerships became most receptive towards them as marketers ran out of the option of getting direct, one-on-one access to physicians. Prior to the outbreak, Rx drug marketers did not consider digital a core part of their marketing strategy. They rather explored some digital channels or associations on an experiment basis only. COVID-19 triggered massive adoption of digital in the pharma marketing industry with brands realising the huge potential digital medium had in streamlining and optimising business outcomes.

Transparency takes centre stage

The prime reason of meagre adoption of digital technologies among pharma industry was non-transparency of doctor reach and results. The Rx drug marketers suffered because of the lack of transparency around digital campaigns as the data did not reflect the true picture in terms of key metrics, including CTRs, clicks and impressions. Now that pharma brands are getting serious about marketing to physicians through digital medium, the clamour for transparency has gone strong. This has led to platforms that provide real-time insights to marketers and enable them to optimise for better outcomes come to the forefront. Going ahead, only those digital platforms would stay in the business of pharma marketing that would support real-time dashboards to marketers.

No compromise with regulatory compliance

Unlike other sectors, pharma industry operates in a strict regulatory-compliant atmosphere. To be able to serve pharma brands in the best possible manner, digital platforms will have to adhere to all the guidelines stipulated by regulatory bodies. Currently, such platforms across the globe are scarce. This is another area which will see a lot of development and activity in the times to come.

The future of pharma marketing lies in digital and that is one thing the pandemic has made a lot clearer.