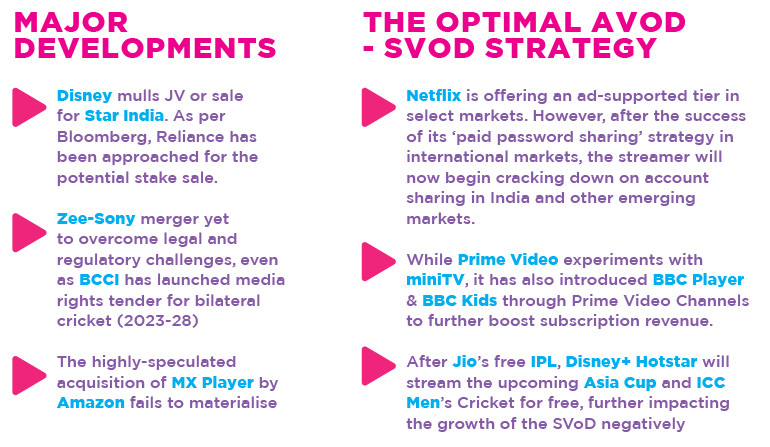

Disney is exploring strategic options for Star India, including a joint venture or a sale, the Wall Street Journal reported last month. The news is clear indication that the global media giant’s returning CEO Bob Iger who was rushed in following the ouster of Bob Chapek last November, is getting down to the brass tacks to achieve the prime objective of his two-year reappointment - making the streaming business profitable. While it has put the spotlight on Disney Star, the tentative development may have a lesson or two for streamers across the board that have been struggling to get the unit economics of the business right.

The glitter of star-studded, high-value content and misleading revenue figures notwithstanding, the Indian OTT industry is grappling with inordinately high content investments, low ARPUs, fragmentation, and increasing competition from other streamers and social. The majority of players have been struggling for profitability, with the likes of SonyLIV and SVF (that operates Hoichoi) being the few exceptions. SVF, which turned profitable in August 2022, relies on premium content, international subscription, and global telecom tie-ups to achieve growth. Brands that own huge content libraries such as Eros and ShemarooMee are also doing better.

Content is clearly one the major areas where OTT businesses are bleeding money, even as they strive to grow and retain subscribers. It is therefore critical for them to maximise the returns on it. Dropping of content that didn’t translate into proportionate benefits has been a direct outcome of Disney’s top exec’s goal-oriented and sharp strategy that has translated into the improved financial performance of their (global) streaming business. While some may argue that this is not the best approach in the high content demand scenario, reining in the content juggernaut also makes sense as the diversion of profits and investments to streaming is jeopardizing the well-established linear TV ecosystem, which at least in India, is yet to grow against regulatory challenges and realize its full potential. ZEEL’s Q4FY23 results on May 25, reporting a net loss of Rs196cr., compared to a net profit of Rs181cr. in the corresponding period last year is, for instance, partly being attributed to investment in ZEE5. The programming and technology cost increased y-o-y due to higher content cost in movies, while the subscription revenue declined one per cent y-o-y. The growth in ZEE5 was offset by decline in linear TV subscription. This erroneous economics is exactly what OTT businesses need to fix on top priority.

BIG ON CONTENT

India is one of Asia’s largest video content markets, with investment totaling US$5bn. in 2022. Historically, television has been the primary medium of content investment, followed by online video and movies. As per Media Partners Asia’s estimates, since 2018, the contribution of online video to total content investments for the industry, including television and films, has nearly doubled. Overall content investment will grow 2x in the next five years to reach US$10bn. with online video matching up investments to that of pay-TV. Explaining the significance of these data points in a nutshell, Mihir Shah, Vice President and Head of India at Media Partners Asia (MPA) remarks, “Content owners will continue to prioritize streaming, as the economic value for the sector is expected to equal if not surpass television by 2027.”

Explaining the significance of these data points in a nutshell, Mihir Shah, Vice President and Head of India at Media Partners Asia (MPA) remarks, “Content owners will continue to prioritize streaming, as the economic value for the sector is expected to equal if not surpass television by 2027.”

According to research led by European economic consultancy Frontier Economics, OCC (Online Curated Content) providers’ direct investment in OCC content worldwide, including original and licensed titles, is likely to soar from $25.7bn (INR1.8trn) in 2019 to $61bn (INR4.3trn) by 2024. Significant increase in content investment in the pipeline include: The Walt Disney Company’s plans to invest $14bn-16bn (INR985bn-1,126bn) per year in global OCC content by 2024; ViacomCBS’ (now Paramount Global) plans to ramp up investment in OCC content to $5bn (INR352bn) in 2024; WarnerMedia’s parent company, AT&T’s pledge to invest $4bn (INR282bn) in HBO Max in the three years through 2022; and, Netflix will spend $28bn (INR1.97trn) a year by 2028.

These global investments will have a resounding impact on the local OCC ecosystem in India as leading players compete to offer high-quality content to meet consumer demand. Among the major developments in India, Jio Cinema’s deals with NBC Universal and earlier Warner Bros. Discovery Inc. to acquire premium content, stole the spotlight. A relatively small player before it gained popularity with its free streaming of the FIFA World Cup 2022, and more importantly, the IPL 2023, the Reliance-owned platform used to compete with ZEE5, SonyLIV, and Disney+Hotstar. The blockbuster deals have catapulted it straight to the league of Netflix and APV. On the back of premium content from HBO, Warner Bros. and NBCUniversal’s content suite from Universal Television, UCP, Universal International Studios, Universal Television Alternative Studio, Sky Studios, DreamWorks Animation, Universal Pictures, Focus Features and Bravo, Jio Cinema recently announced its premium subscription for Rs. 999 per year, allowing users to stream content on four devices simultaneously.

In addition to these licensing deals, it has reportedly invested Rs 2000cr. to produce over 100 films and web series. Sharing his views on how it could benefit them, Bhavya Khurana, Vice President – Media, Digitas India states, “Even with a sizeable roster of shows and movies, it’s challenging to get viewers to try new content or content outside of their usual preferences. So, Jio will need to ensure that there is a sizeable spread of roster for all audience cohorts to reap the benefits. However, the potential benefit to their Telco business is significant. Research shows users are willing to spend more on their telecom bill for the right bundle at the right price point. With a higher incidence of bundled subscribers over direct subscribers and a massive 280mn smartphone subscriber base under Jio, bundled ARPU should grow significantly.” In a further push to the OTT play, Reliance Jio’s newly launched 4G-enabled feature phone ‘Jio Bharat’ comes preloaded with Jio Cinema and other Jio applications such as Jio Pay and Jio Saavn.

Mitesh Kothari, Co-founder and Chief Creative Officer, White Rivers Media shares that in FY2021 alone, OTT platforms invested about INR 55.21 bn, out of which leading players like Netflix, Sony LIV, Amazon Prime Video, and Disney+ Hotstar had a combined invested value of INR 31.55 billion. India’s net OTT market revenue was about $2.35 billion in 2022. “Both SVoD and AVoD formats appeal to the masses who differ widely in their routines and viewing patterns. They have their unique preferences when it comes to viewing the content or paying for it. Thus far, SVoD has been leading the sector, but AVoD is also catching up pretty fast. The trends may pivot over time owing to newer users joining in with newer inclinations,” he said.

Mitesh Kothari, Co-founder and Chief Creative Officer, White Rivers Media shares that in FY2021 alone, OTT platforms invested about INR 55.21 bn, out of which leading players like Netflix, Sony LIV, Amazon Prime Video, and Disney+ Hotstar had a combined invested value of INR 31.55 billion. India’s net OTT market revenue was about $2.35 billion in 2022. “Both SVoD and AVoD formats appeal to the masses who differ widely in their routines and viewing patterns. They have their unique preferences when it comes to viewing the content or paying for it. Thus far, SVoD has been leading the sector, but AVoD is also catching up pretty fast. The trends may pivot over time owing to newer users joining in with newer inclinations,” he said.

FREEBIES SPOIL THE GAME IN THE INDIA MARKET

Even as content investments skyrocket, the Indian OTT industry that is currently in more or less the same stage as startups (burning cash to acquire customers, or subscribers in this case) is faced with another challenge. The freebie economics pioneered by Jio Cinema offering IPL- the most expensive content IP - has caused disruption in the fragmented and price-sensitive market. According to Elara Capital, Jio Cinema was unable to recover more than 35% of its content cost by going pure AvoD on IPL16. Following suit, Disney+Hotstar will now be offering cricket content free to mobile subscribers. Karan Taurani, Senior Vice President, Elara Capital warns, “If continued over the medium term, this may result in higher losses and lead to consolidation as many may be unable to survive with low ARPU and free offerings. Subscription revenue growth for global/broadcaster-led OTT platforms which are SVOD/freemium based respectively, will be negatively impacted. Overall, offering premium content free does not augur well. Freemium is the best way ahead for the industry.”

Following suit, Disney+Hotstar will now be offering cricket content free to mobile subscribers. Karan Taurani, Senior Vice President, Elara Capital warns, “If continued over the medium term, this may result in higher losses and lead to consolidation as many may be unable to survive with low ARPU and free offerings. Subscription revenue growth for global/broadcaster-led OTT platforms which are SVOD/freemium based respectively, will be negatively impacted. Overall, offering premium content free does not augur well. Freemium is the best way ahead for the industry.”

Commenting on the possible impact of this trend on SVOD, MPA’s Shah states, “After a multifold growth in SVOD subscriptions, the number of paid subscriptions in 2023 will shrink due to Jio Cinema going free with IPL to subsume existing D2C platforms – Voot Select and Voot Kids. Disney+ Hotstar’s decision to stream the upcoming Asia Cup and ICC Men’s Cricket World Cup for free will further result in sharp contraction in the number of paying subscribers. We estimate after having surpassed 112 million paid subscriptions last year the total subscription will decline to 78 million by the end of 2023. The market will take a breather before rebounding again in 2024.”

According to Business Growth & Strategy Advisor (ex, SVP- Marketing, Partnerships & Revenue, ALTBalaji) Divya Dixit, “SVoD is one of the most sustainable ways for OTT platforms to generate revenue”, yet she maintains that “the intensifying need for ROI justification is bound to lead to AVoD+SVoD experiments as we have seen with Netflix and APV.” On the potential of AVoD, and talking of how advertising dollars compare on OTT and TV, she notes, “The precision and unskippable nature of OTT ads are the reasons for brands to pay OTT at par with TV, however, that will only get enforced better once OTT platforms have a central measurement currency.”

According to Business Growth & Strategy Advisor (ex, SVP- Marketing, Partnerships & Revenue, ALTBalaji) Divya Dixit, “SVoD is one of the most sustainable ways for OTT platforms to generate revenue”, yet she maintains that “the intensifying need for ROI justification is bound to lead to AVoD+SVoD experiments as we have seen with Netflix and APV.” On the potential of AVoD, and talking of how advertising dollars compare on OTT and TV, she notes, “The precision and unskippable nature of OTT ads are the reasons for brands to pay OTT at par with TV, however, that will only get enforced better once OTT platforms have a central measurement currency.” Rahul Satoskar - Chief Investment Officer – EssenceMediacom believes that expected double digit growth of the OTT industry over the next 2-3 years will be driven by both AVoD and SVoD growing at a similar pace. “AVOD becomes more important in situations of economic slowdown or high consumer inflation (as it is now) as viewers try to rationalise spending and seek more value at every purchase, including entertainment. This trend has been seen globally too in the aftermath of COVID when developed countries saw high consumer inflation. Not just existing viewers, the new to platform consumers will also be targeted with the AVOD model. Therefore, the emerging trend amongst OTT players is now shifting to an ‘&’ model rather than an ‘OR’ model between AVoD and SVoD. Key OTT players who operated only on subscription so far, are exploring hybrid models wherein the base price is subsidised for ads.”

Rahul Satoskar - Chief Investment Officer – EssenceMediacom believes that expected double digit growth of the OTT industry over the next 2-3 years will be driven by both AVoD and SVoD growing at a similar pace. “AVOD becomes more important in situations of economic slowdown or high consumer inflation (as it is now) as viewers try to rationalise spending and seek more value at every purchase, including entertainment. This trend has been seen globally too in the aftermath of COVID when developed countries saw high consumer inflation. Not just existing viewers, the new to platform consumers will also be targeted with the AVOD model. Therefore, the emerging trend amongst OTT players is now shifting to an ‘&’ model rather than an ‘OR’ model between AVoD and SVoD. Key OTT players who operated only on subscription so far, are exploring hybrid models wherein the base price is subsidised for ads.”

REALISING AVOD’s FULL POTENTIAL - WHAT MORE DO MARKETERS WANT?

As per Deloitte, AVoD platforms are expected to continue to pull in more revenue than SVoD, increasing from the current $1.1 billion in 2021 to $2.4 billion in 2026. SVoD is expected to grow from its current $0.8 billion to $2.1 billion in 2026. OTT platforms may have become staples for a good number of brands today, but unlocking the full potential of AVoD is still a few steps away. Despite encouraging figures & trends, Khurana (Digitas India) points out, “The challenge for AVoD OTT platforms is that they’re competing with all digital platforms - right from Instagram and Twitter to gaming platforms, and Google. YouTube India dominates the online video-on-demand ad pie with roughly 70% share.”

This fear has also kept smaller and niche OTT brands from exploring the AVoD business model. Abhishek Jain, Founder of CineMan Productions Limited, OHO Gujarati, comments, “We haven’t consciously thought of AVOD as a model for our business because we are too nascent to venture into it and somewhere there is a belief that we want to inculcate the culture of paying customers. Also, the moment we shift to AVOD, we will be in direct competition with the likes of YouTube, which can prove fatal. Though it’s a completely different platform, from a user perspective, it’s all the same. Also, looking at the CPMs, it’s too early for us to get into AVOD for now.” Among marketers, FMCG giant Dabur India’s OTT spends stand in the range of 15-20% of paid digital media spends currently. The medium has served to drive relevant reach and other brand metrics in the activated pockets. Rajiv Dubey, Head Media, Dabur India Ltd. says, “We leverage OTT to target affinity audiences with tent pole properties. Because OTT offers the opportunity to serve completed views on long formats, it is useful when we want to drive new communication. Additionally, we sometimes use it to build frequency with particular audience segments.”

Among marketers, FMCG giant Dabur India’s OTT spends stand in the range of 15-20% of paid digital media spends currently. The medium has served to drive relevant reach and other brand metrics in the activated pockets. Rajiv Dubey, Head Media, Dabur India Ltd. says, “We leverage OTT to target affinity audiences with tent pole properties. Because OTT offers the opportunity to serve completed views on long formats, it is useful when we want to drive new communication. Additionally, we sometimes use it to build frequency with particular audience segments.”

Commenting on the challenges Dubey adds, “Standalone OTT is much more expensive than traditional TV or YouTube deployments. If deployed via DV360, while costs are at par with YT, scale is often a challenge. Also, the leading OTT player is a walled garden and hence there are challenges related to unduplicated reach across campaigns, first party data activation etc.”

Rajeev Jain, Vice President, Corporate Marketing, DS Group, emphasizes on the need for a common currency to make TV, OTT and CTV measurement more accurate and reliable. “The common currency against which we usually measure is Cost of Reach/1000 people with an ad layering with quality aspects. Rate comparison between TV and OTT will vary depending upon target audience, geographical territories, etc. If we are targeting specific towns and select consumer segment, cost on OTT is little lower than TV, else TV may be slightly cheaper. Currently CTV rates are somewhat higher, but we get a less cluttered environment and the target segment is relatively premium with higher disposable income. Also, we get dual benefit of impact and specific targeting so we consider CTV even at higher cost.”

Rajeev Jain, Vice President, Corporate Marketing, DS Group, emphasizes on the need for a common currency to make TV, OTT and CTV measurement more accurate and reliable. “The common currency against which we usually measure is Cost of Reach/1000 people with an ad layering with quality aspects. Rate comparison between TV and OTT will vary depending upon target audience, geographical territories, etc. If we are targeting specific towns and select consumer segment, cost on OTT is little lower than TV, else TV may be slightly cheaper. Currently CTV rates are somewhat higher, but we get a less cluttered environment and the target segment is relatively premium with higher disposable income. Also, we get dual benefit of impact and specific targeting so we consider CTV even at higher cost.”

Currently, DS Group’s share of advertising on OTTs is in the range of 20-25% of Digital media spends. Some of the platforms it has leveraged include YouTube, Hotstar, Sony LIV, Zee5, Netflix, and Prime Video. “Generally, we use OTT platforms along with TV campaigns to build incremental reach at a lower cost, over and above TV in a more engaging manner. At times we use them in isolation too, for certain tactical campaigns or for sustained visibility of brand campaigns,” shares Jain. Car-maker Maruti Suzuki’s focus on OTT has been growing proportional to audiences’ drift to the platform. “OTT is about 10% of our TV spends, and we expect this number to keep increasing. The current break-up is (approx.) TV 37%, Digital 30% (excluding OTT which is 4%), Print 24%, and others (Radio, Cinema, OOH) 6%, Shashank Srivastava, Senior Executive Officer, Marketing and Sales, Maruti Suzuki India tells us. Apart from ads, brand integrations/product placements are frequently used, particularly on non-advertising streaming platforms,” he shares.

Car-maker Maruti Suzuki’s focus on OTT has been growing proportional to audiences’ drift to the platform. “OTT is about 10% of our TV spends, and we expect this number to keep increasing. The current break-up is (approx.) TV 37%, Digital 30% (excluding OTT which is 4%), Print 24%, and others (Radio, Cinema, OOH) 6%, Shashank Srivastava, Senior Executive Officer, Marketing and Sales, Maruti Suzuki India tells us. Apart from ads, brand integrations/product placements are frequently used, particularly on non-advertising streaming platforms,” he shares.

RECOVERING CONTENT INVESTMENTS - TECH AND COLLABORATIONS The emergence of OTTs has revolutionised the way Indians consume content, bringing cinematic quality productions directly to their screens outside of traditional theaters. This shift has created significant opportunities for the VFX and animation industries in India. Merzin Tavaria, President, Global Production and Operations, DNEG, shares that the industry has much to offer OTTs in return, particularly in the context of lowering the cost of content creation with the use of Virtual Production - a creative technology that is bringing about changes in the production of filmed content.

The emergence of OTTs has revolutionised the way Indians consume content, bringing cinematic quality productions directly to their screens outside of traditional theaters. This shift has created significant opportunities for the VFX and animation industries in India. Merzin Tavaria, President, Global Production and Operations, DNEG, shares that the industry has much to offer OTTs in return, particularly in the context of lowering the cost of content creation with the use of Virtual Production - a creative technology that is bringing about changes in the production of filmed content.

“Virtual Production can significantly reduce film production costs by allowing real-time creative decisions to be made in a controlled environment, eliminating expensive post-production changes and the need for extensive location scouting and expenses. By utilising LED video walls and real-time visualisation, virtual production minimises set and location costs by creating digital environments instead of physical sets, thereby reducing expenses related to construction, decoration, scouting, permits, and travel. It enhances production efficiency by allowing for real-time changes to the virtual environment, resulting in time and resource savings. Accurate pre-visualisation enables early issue identification, reducing the likelihood of costly reshoots. The seamless integration of live-action footage with CGI reduces the need for extensive post-production work,” he says.

The technology can also usher economies of scale through faster iteration of creative possibilities, thereby increasing production efficiencies. “Through real-time creative decisions, on-set visualisation, and innovative techniques like Simulcam and In-Camera VFX (ICVFX), filmmakers can streamline the filmmaking process and enhance collaboration, allowing them to create content more efficiently,” adds Tavaria.

With an increase in competition, market fragmentation, subscription fatigue, as well as content promotion costs, both standalone and network players are realizing the importance of making content discovery easier and effective, and thus the growing relevance of aggregators i.e. collaborations. The biggest indicator of this trend in India was the launch of ‘Channels’ in 2021, which turned Prime Video into a content aggregator. Prime Video Channels kickstarted with 8 premium content providers - discovery+, Lionsgate Play, Eros Now, DocuBay, MUBI, hoichoi, manoramaMAX, and ShortsTV – available with add-on subscriptions to Prime members in India. The number has grown today.

Another trend that picked up through the pandemic years or the years of the OTT boom in India, was multi-year content partnerships between streaming platforms and mainstream production houses like the Netflix India-Excel Entertainment and ZEE5-Applause Entertainment deals.

With the introduction of 5G, there will be newer OTT startups as well as audience mass increasing on digital, all of which will further fuel the demand for content, observes Divya Dixit. “Rising competition will necessitate collaborations and partnerships between mega production houses and OTT platforms in order to amortise costs over a few projects. Platforms may also play on profit sharing deals and co-production models. In the current scenario with cut-throat competition, the need of the hour is “better content at lower costs and sensible partnerships,” she says.

CHANGING DYNAMICS

Reed Hastings - Netflix co-founder and the then CEO of the company, stirred up a media storm when he expressed “his frustration on the lack of success in India”, in an earnings call in January, 2022. The comment came weeks after the streaming giant slashed prices in India by as much as 25% in December 2021 for the first time since 2016, the year when Netflix entered India. Referring to the Indian audiences as ‘ad-tolerant consumers’, Hastings subsequently went on to say that it made sense to cater to them and that Netflix would, over the course of the next couple of years, explore ways to air ads on its platform.

Cut to today, Netflix is offering an ad-supported tier in select markets for the ‘ad-tolerant, price-sensitive consumers’, and Prime Video is experimenting with miniTV. The curious case of India, with among the lowest ARPUs and where the average price for cable is just about $3 per month, has necessitated the emergence of innovative monetisation and subscription models, over and above AVoD and SVoD.

More recently, on the back of its innovative ‘paid password sharing’ strategy, Netflix posted 8%YoY global subscriber growth in Q2CY23. It added 7.6mn new subs in H1CY23, against the loss of 1.2mn subs in H1CY22. Netflix started cracking down on account sharing in India and other markets such as Indonesia, Croatia, and Kenya from July 20.

“The company will not offer the extra member option in these markets since they had recently cut prices in many of them. The penetration is still relatively low, giving plenty of runway without creating additional complexity. Expect some Indian broadcaster-led OTT giants to follow this model in order to drive subscription revenue in a price sensitive market. We believe one leg of subscription revenue i.e. ARPU, will see pressure over the near-to-medium term due to premium content being offered free,” says Karan Taurani.

While the highly-discussed Amazon-MX Player Deal, that was expected to garner reach for the American streaming giant, has reportedly been called off, the company is betting on new avenues to increase subscription revenues. It has recently introduced BBC Player and BBC Kids in India through Prime Video Channels. In spite of being one of the most popular OTT platforms, MX Player has lacked a clear positioning with respect to content, ever since it began transitioning from a video player to a streaming service - a clear disadvantage in the content-led ecosystem.

New models and strategies, led by the might and muscle of global brands as well as the ingenuity of the regional ones, are evolving rapidly in the OTT-verse. Needless to say, in a country like India where internet penetration and even the number of TV households is still growing, there’s immense scope for streaming. Survival and success in the value-conscious, price-sensitive, and increasingly competitive and complex market will depend on the combination of above factors and more.

Experts reckon that consolidation will further and ultimately shape the game. Even as the industry waits for the highly-anticipated merger between ZEEL and Culver Max (earlier SPNI) to sail through, Reliance, which was among the contenders in this deal, has been, according to Bloomberg, approached for a potential stake sale in Star India. Interesting times ahead!

(With inputs from Imran Fazal)